Not known Details About Hsmb Advisory Llc

Not known Details About Hsmb Advisory Llc

Blog Article

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

Table of ContentsA Biased View of Hsmb Advisory LlcUnknown Facts About Hsmb Advisory LlcThe 6-Second Trick For Hsmb Advisory LlcThe smart Trick of Hsmb Advisory Llc That Nobody is Discussing9 Easy Facts About Hsmb Advisory Llc Shown6 Simple Techniques For Hsmb Advisory Llc4 Simple Techniques For Hsmb Advisory Llc

Also be mindful that some plans can be expensive, and having certain wellness conditions when you use can raise the costs you're asked to pay. Life Insurance. You will need to ensure that you can manage the premiums as you will certainly require to dedicate to making these repayments if you desire your life cover to stay in placeIf you feel life insurance coverage could be beneficial for you, our collaboration with LifeSearch permits you to obtain a quote from a variety of suppliers in dual fast time. There are various types of life insurance that aim to fulfill numerous security demands, including degree term, reducing term and joint life cover.

Fascination About Hsmb Advisory Llc

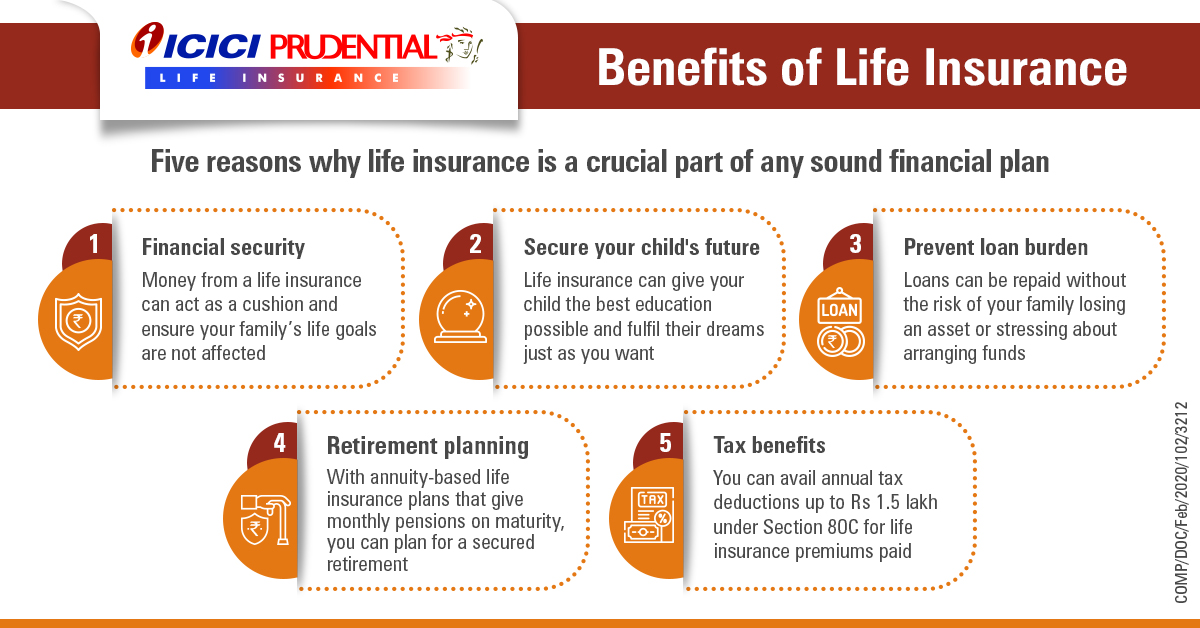

Life insurance coverage supplies 5 financial advantages for you and your family members (Insurance Advisors). The major advantage of including life insurance policy to your financial strategy is that if you die, your successors obtain a swelling sum, tax-free payout from the policy. They can utilize this cash to pay your last expenditures and to change your income

Some plans pay if you establish a chronic/terminal health problem and some offer cost savings you can use to sustain your retired life. In this post, discover about the various benefits of life insurance policy and why it might be an excellent concept to invest in it. Life insurance policy offers benefits while you're still active and when you pass away.

Hsmb Advisory Llc - The Facts

If you have a policy (or plans) of that size, individuals that depend on your earnings will certainly still have cash to cover their recurring living costs. Recipients can utilize plan advantages to cover critical everyday expenditures like rental fee or home mortgage repayments, energy bills, and groceries. Typical yearly expenses for homes in 2022 were $72,967, according to the Bureau of Labor Data.

Hsmb Advisory Llc Fundamentals Explained

In addition, the cash worth of entire life insurance coverage expands tax-deferred. As the money worth builds up over time, you can utilize it to cover costs, such as purchasing a vehicle or making a down payment on a home.

If you decide to obtain versus your cash money value, the funding is not subject to revenue tax as long as the plan is not surrendered. The insurance provider, however, will certainly bill rate of interest on the funding amount till you pay it back (https://dzone.com/users/5127111/hsmbadvisory.html). Insurance provider have differing passion rates on these loans

Rumored Buzz on Hsmb Advisory Llc

As an example, 8 out of 10 Millennials overestimated the expense of life insurance policy in a 2022 research. In reality, the average price is more detailed to $200 a year. If you believe spending in life insurance policy might be a clever economic relocation for you and your family members, take into consideration speaking with a financial consultant to adopt it into your financial plan.

The 5 primary kinds of life insurance coverage are term life, whole life, universal life, variable life, and final expense protection, additionally recognized as interment insurance coverage. Each type has different features and advantages. For instance, term is extra economical but has an expiration day. Whole life begins out setting you back a lot more, however can last your entire life if you maintain paying the premiums.

The Only Guide to Hsmb Advisory Llc

It can pay off your financial debts and medical costs. Life insurance might also cover your home mortgage and give cash for your family members to keep paying their expenses. If you have family members depending upon your revenue, you likely need life insurance policy to support them after you die. Stay-at-home moms and dads and entrepreneur also commonly require life insurance coverage.

Essentially, there are two types of life insurance policy plans - either term or permanent strategies or some mix of the 2. Life insurers offer different forms of term strategies and traditional life plans along with "rate of interest sensitive" items which have actually ended up being much more prevalent because the 1980's.

Term insurance policy gives defense for a specific duration of time. This duration could be as brief as one year or offer coverage for a details number of years such as 5, 10, two decades or to a defined age such as 80 or in many cases up to the oldest age in the life insurance mortality.

Indicators on Hsmb Advisory Llc You Need To Know

Presently term insurance prices are very affordable and amongst the cheapest historically seasoned. It ought to be noted that it is an extensively held belief that term insurance policy is the least expensive pure life insurance policy coverage offered. One requires to review the policy terms very carefully to decide which term life choices are ideal to satisfy your particular conditions.

With each new term the premium is boosted. The right to restore the plan without evidence of insurability is an essential benefit to you. Otherwise, the risk you take is that pop over to these guys your wellness may degrade and you might be incapable to get a policy at the same rates and even in all, leaving you and your recipients without insurance coverage.

Report this page